Aligning Money and Strategy in Creating Agile Organisations

By Cesario Ramos

Portfolio management is how we decide where money and people go across customer facing units, business units and platforms so that our investment supports our strategy in resourcing, not just in slides.

When Strategy and Spending Don’t Match

When money and capacity allocation does not match strategy, business performance goes down while costs and complexity grow. Many

This all means that funding and current reality are out of sync. Groups might learn fast but cannot shift resources, and money keeps flowing where it no longer should.

Such a setup creates long chains of meetings and discussions, driving up coordination costs and making idea-to-result very slow. IT and the back of the organisation become overloaded. Over time, this quietly increases cost, risk and complexity, without one place where these choices are really aligned with strategy.

How Portfolio Management Works in CAO

In CAO, the organisation is built around three enterprise roles.

- Product groups that develop assets. Each group contains value areas that represent a coherent chunk of customer value.

- Commodity platforms at the back that build for efficiency and scale.

- Go-to-market units at the front that coordinate value creation in the market.

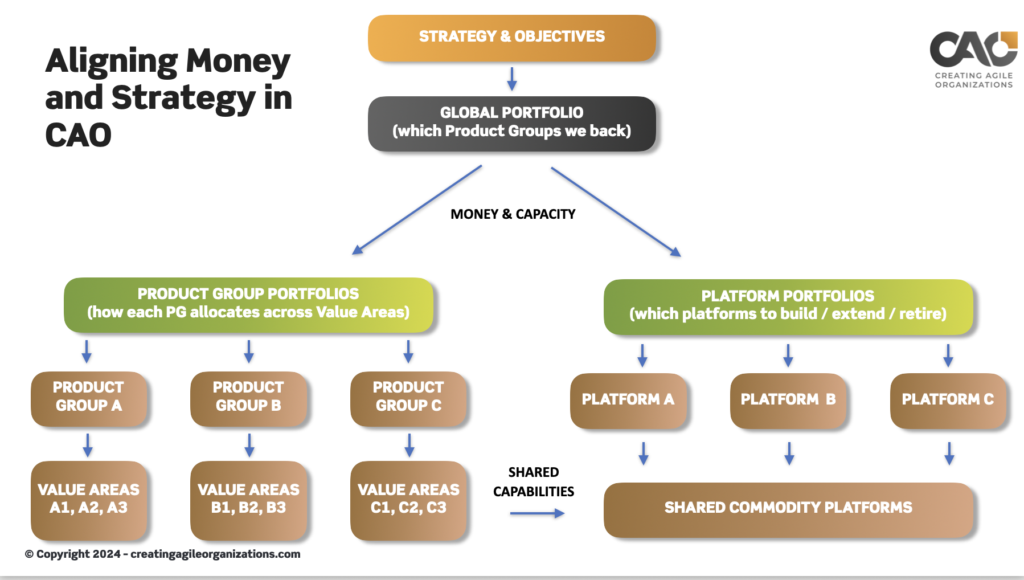

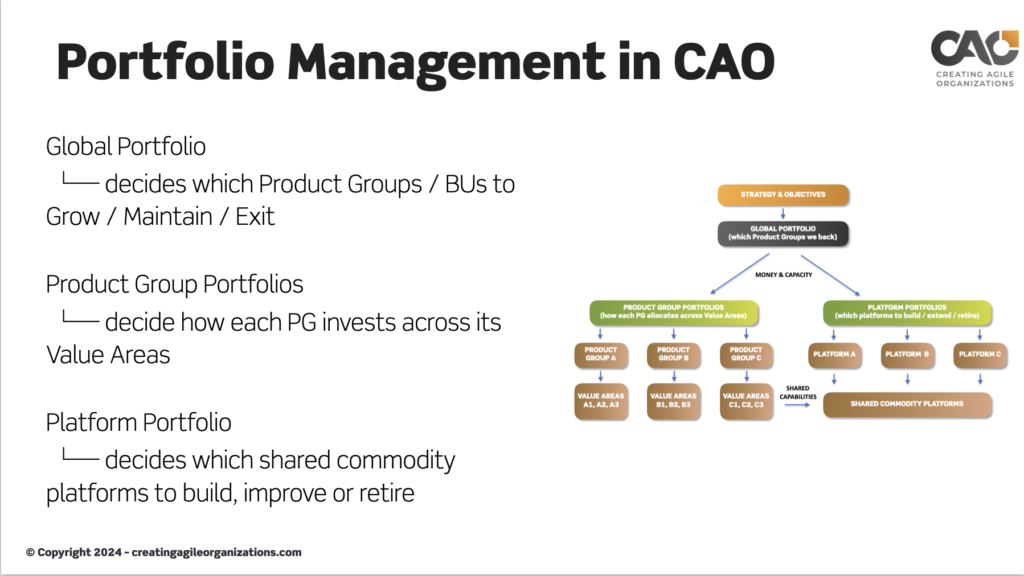

In CAO, portfolio management is the way we decide how money and capacity flow across these three layers: which product groups to grow, maintain or exit; which value areas inside each product group get more or less investment; and which platforms to build, extend or retire to balance cost, risk and new capabilities. It runs as three linked portfolios:

- Global portfolio

- Product group portfolio and

- Platform portfolio.

It focuses leaders on a limited number of clear bets. In other words, portfolio management here is not about approving small projects and features, but about aligning market, product and platform units, deciding which bets get real money and which do not.

Why This Model Matters

This setup gives management clear ownership of results. It also gives product groups and value areas with clear goals and sharp accountability. These loosely coupled product groups and self-service platforms shorten lead times and reduce coordination overhead.

That setup is reinforced by governance. The global and product group portfolios make strategy visible in how money is actually allocated. Shared commodity platforms portfolio, might be about cutting duplication and structural cost while keeping product teams moving fast.

PS. If you have a consolidated front (regions, countries, channels), the global portfolio does not pick products or regions in isolation; it picks product–market plays, so product investment, platform capacity and commercial focus line up around the same bets.

Download The Full White Paper

Download: Aligning Money With Strategy in Creating Agile Organizations.